Business Insurance Checklist for First-Time Entrepreneurs provides a detailed roadmap for navigating the complex world of insurance, ensuring new business owners are well-equipped to protect their ventures. From understanding the importance of insurance to choosing the right coverage, this guide covers it all.

Starting a business can be daunting, but with the right insurance checklist in hand, first-time entrepreneurs can confidently safeguard their hard work and investments.

Importance of Business Insurance

As a first-time entrepreneur, securing business insurance is crucial to protect your investment and assets. It provides financial protection against unexpected events that could potentially cripple your business.

Examples of Potential Risks Covered by Business Insurance

- Property Damage: In the event of a fire, natural disaster, or vandalism, business insurance can help cover the costs of repairing or replacing damaged property.

- Liability Claims: If a customer or third party is injured on your business premises, business insurance can help cover legal fees and settlement costs.

- Business Interruption: If your business operations are halted due to unforeseen circumstances, such as a pandemic or supply chain disruption, business insurance can provide coverage for lost income.

Legal Requirements and Implications of Inadequate Business Insurance

Not having adequate business insurance can lead to severe legal and financial consequences. Some implications include:

- Violating State Laws: Many states require businesses to have certain types of insurance, such as workers' compensation or commercial auto insurance. Failing to comply with these laws can result in fines or legal action.

- Lawsuits: Without liability insurance, your business could be vulnerable to costly lawsuits that may bankrupt your company.

- Loss of Assets: In the absence of adequate coverage, you may have to pay for damages or losses out of pocket, putting your personal assets at risk.

Types of Business Insurance Coverage

As a first-time entrepreneur, it is crucial to understand the various types of business insurance coverage available to protect your business from unforeseen risks and liabilities.

General Liability Insurance

General liability insurance provides coverage for third-party claims of bodily injury, property damage, and advertising injury. For example, if a customer slips and falls in your store, general liability insurance would cover their medical expenses and any legal fees if they decide to sue your business.

Property Insurance

Property insurance protects your business property, including buildings, equipment, inventory, and assets, from damages caused by fire, theft, vandalism, or natural disasters. In a scenario where your office is damaged due to a fire, property insurance would help cover the cost of repairs or replacement.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, provides coverage for claims of negligence, errors, or omissions in the services you provide. For instance, if a client alleges that your advice led to financial losses, professional liability insurance would cover legal expenses and damages awarded in a lawsuit.

Assessing Insurance Needs

When starting a business, it is crucial for first-time entrepreneurs to assess their insurance needs carefully. This process involves evaluating the risks associated with their specific industry and determining the right amount of coverage to protect their business.

Factors to Consider for Insurance Coverage

- Understand the nature of your business: Consider the type of products or services you offer, the size of your business, and the number of employees you have.

- Assess potential risks: Identify potential risks such as property damage, liability claims, or business interruptions that could impact your operations.

- Evaluate legal requirements: Research the insurance requirements specific to your industry or state to ensure compliance with regulations.

- Review your budget: Determine how much you can afford to spend on insurance premiums while still maintaining adequate coverage.

Tips for Evaluating Industry-Specific Risks

- Conduct a risk assessment: Identify the unique risks associated with your industry, such as cybersecurity threats for tech companies or product liability for manufacturers.

- Consult with industry experts: Seek advice from professionals who understand the specific risks and insurance needs of your industry.

- Review historical data: Analyze past incidents or claims within your industry to anticipate potential future risks.

- Stay informed: Keep up-to-date with industry trends and regulations that could impact your insurance needs.

Choosing an Insurance Provider

When it comes to choosing an insurance provider for your business coverage, there are several key factors to consider to ensure you make the right decision. It's essential to compare different insurance companies based on their reputation, coverage options, and cost to find the best fit for your business needs.

Additionally, knowing how to negotiate rates or customize a policy can help you tailor the coverage to suit your specific requirements.

Factors to Consider When Selecting an Insurance Provider

- Reputation: Look for insurance providers with a solid reputation in the industry, known for their reliability and customer service.

- Coverage Options: Evaluate the range of coverage options offered by different companies to ensure they meet your business's unique needs.

- Cost: Compare quotes from multiple insurance providers to find a balance between cost and coverage that aligns with your budget.

Tips for Negotiating Rates or Customizing a Policy

- Bundle Policies: Consider bundling multiple types of coverage with the same provider to potentially receive a discount on your premiums.

- Review and Update: Regularly review your policy to ensure it reflects any changes in your business operations or assets, and update as needed.

- Seek Professional Advice: Consult with an insurance agent or broker to help you navigate the process and make informed decisions about your coverage.

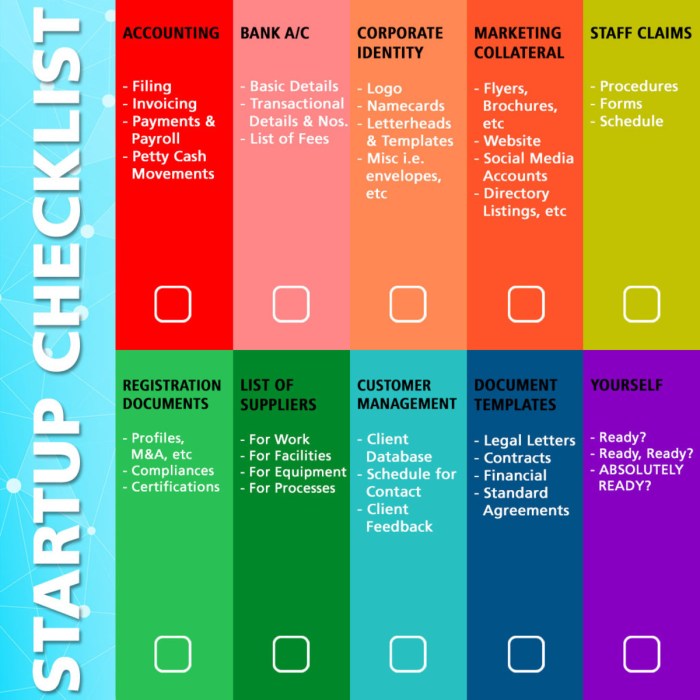

Creating a Business Insurance Checklist

As a first-time entrepreneur, it's crucial to have a comprehensive insurance checklist to protect your business from unforeseen risks. This checklist will help you ensure that you have all the necessary coverage in place to safeguard your assets and operations.

Key Items to Include in the Checklist:

- Policy Details: Clearly Artikel the specifics of each insurance policy you have, including the type of coverage, premiums, deductibles, and any exclusions.

- Coverage Limits: Specify the maximum amount that your insurance will pay out in the event of a claim. Make sure these limits align with your business's potential risks.

- Renewal Dates: Keep track of when each policy needs to be renewed to avoid any coverage gaps. Set reminders well in advance to ensure timely renewal.

- Contact Information: Maintain a list of contact details for your insurance provider, including phone numbers, emails, and any relevant support channels.

Guidance for Review and Updates:

Regularly reviewing and updating your insurance checklist is essential as your business grows and evolves. Here are some tips to help you stay on top of your insurance needs:

- Annual Review: Conduct an annual review of your insurance policies to ensure they still align with your business's needs. Consider any changes in operations, assets, or risks that may require adjustments to your coverage.

- Consult with Experts: Seek guidance from insurance professionals or brokers to assess whether your current coverage is adequate or if any additional policies are necessary.

- Document Changes: Keep detailed records of any updates or changes to your insurance coverage. Make sure to update your checklist accordingly to reflect these modifications.

Last Word

In conclusion, Business Insurance Checklist for First-Time Entrepreneurs serves as a vital tool in securing the future of a new business. By following the guidelines Artikeld in this comprehensive checklist, entrepreneurs can mitigate risks and focus on growing their ventures with peace of mind.

FAQ Section

What are the legal implications of not having business insurance?

Not having adequate business insurance can expose entrepreneurs to lawsuits, financial losses, and even the risk of business closure.

How can first-time entrepreneurs determine the right amount of coverage?

First-time entrepreneurs should consider factors like business size, industry risks, and potential liabilities to determine the appropriate coverage amount.

Is it necessary for first-time entrepreneurs to regularly update their insurance checklist?

Yes, it is crucial for entrepreneurs to review and update their insurance checklist regularly to ensure they are adequately protected as their business evolves.