High-Value Property Insurance: Do You Really Need It? sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with a casual formal language style and brimming with originality from the outset.

In the following paragraphs, we will delve into the specifics of high-value property insurance, exploring its significance and the various aspects that influence the need for such coverage.

Introduction to High-Value Property Insurance

High-value property insurance is a specialized type of insurance coverage designed to protect luxury homes, estates, valuable belongings, and other high-worth properties from potential risks and damages.

Insuring high-value properties is crucial as these assets often come with a higher replacement cost and unique features that may require specific coverage not typically included in standard homeowners' insurance policies.

Types of Properties Requiring High-Value Insurance Coverage

- Luxury Homes: Properties with high-end finishes, custom features, and unique architectural designs.

- Estates: Expansive properties with multiple structures, valuable art collections, and extensive grounds.

- Historic Homes: Properties with significant historical value that require specialized restoration or preservation.

- High-Value Belongings: Valuable jewelry, antiques, fine art, and collectibles that may exceed coverage limits of standard policies.

- Rental Properties: High-end rental properties used for investment purposes that need extra protection.

Coverage Options and Benefits

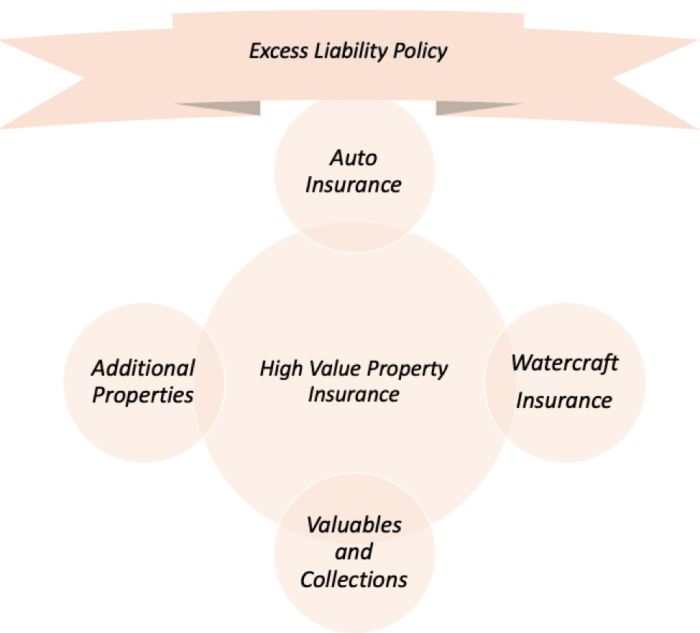

High-value property insurance offers a range of coverage options tailored specifically for valuable properties. These options provide unique benefits that go beyond what standard insurance policies typically offer.

Specific Coverage Options

- Extended Replacement Cost Coverage: High-value property insurance often includes extended replacement cost coverage, which covers the cost of rebuilding your home even if it exceeds the policy limit.

- Cash Settlement Option: In the event of a covered loss, you may have the option to receive a cash settlement rather than having the insurance company repair or replace the damaged property.

- High-Value Contents Coverage: This coverage extends beyond standard personal property coverage to protect high-value items such as fine art, jewelry, and collectibles.

Benefits of High-Value Property Insurance

- Agreed Value Coverage: High-value property insurance typically offers agreed value coverage, ensuring that you receive the full value of your property in the event of a covered loss.

- Dedicated Claims Specialists: Insurance companies that specialize in high-value property insurance often provide dedicated claims specialists who understand the unique needs of high-net-worth individuals.

- Customizable Coverage: High-value property insurance policies can be tailored to your specific needs, allowing you to add coverage for features like home offices, wine collections, or high-end electronics.

Factors Influencing the Need for High-Value Property Insurance

When determining the need for high-value property insurance, several factors come into play. These factors include the location of the property, the features of the property itself, and the current market trends in the real estate industry.

Location of the Property

The location of a property plays a crucial role in determining the need for high-value insurance. Properties located in areas prone to natural disasters such as hurricanes, earthquakes, or floods are at a higher risk of sustaining damage. In such cases, high-value property insurance can provide the necessary coverage to protect against these risks.

Features of the Property

The features of a property, such as the construction materials used, the age of the property, and any additional amenities like swimming pools or guest houses, can impact the need for specialized insurance. High-end materials or unique architectural designs may require specific coverage to ensure that any damage or loss is adequately compensated.

Market Trends in the Real Estate Industry

Market trends in the real estate industry can also influence the need for high-value property insurance. In a volatile market where property values are fluctuating, it is essential to have insurance that reflects the true value of the property. Additionally, market trends can impact the cost of rebuilding or repairing a high-value property, making comprehensive insurance coverage crucial.

Cost Considerations and Affordability

When it comes to high-value property insurance, the cost is a significant factor to consider. Understanding how the cost is calculated and finding ways to make it more affordable can help property owners make informed decisions.The cost of high-value property insurance is typically calculated based on several factors, including the value of the property, its location, the level of coverage needed, and the insurance company's risk assessment.

Generally, the higher the value of the property and the greater the risk of potential damage or loss, the higher the insurance premium will be.

Factors Influencing Insurance Costs

- The value of the property: The higher the value of the property, the more expensive the insurance premium.

- Location: Properties in high-risk areas, such as flood zones or areas prone to natural disasters, may have higher insurance costs.

- Level of coverage: More comprehensive coverage will generally result in higher premiums.

- Security measures: Properties with advanced security systems may qualify for discounts on insurance premiums.

It's important to shop around and compare quotes from different insurance companies to find the best coverage at a competitive price.

Tips for Reducing Insurance Costs

- Bundle insurance policies: Combining high-value property insurance with other policies, such as auto or umbrella insurance, can lead to discounts.

- Improve security: Installing security systems, smoke detectors, and other safety measures can help reduce insurance costs.

- Increase deductibles: Opting for a higher deductible can lower insurance premiums, but it's essential to ensure you can afford the out-of-pocket costs in case of a claim.

- Maintain a good credit score: Some insurance companies consider credit scores when calculating premiums, so maintaining a good credit score can help lower costs.

Assessing the Value of High-Value Property Insurance

- Consider the potential risks: Evaluate the risks associated with your property and determine if the benefits of high-value property insurance outweigh the costs.

- Peace of mind: High-value property insurance can provide peace of mind knowing that your investment is protected in case of unexpected events.

- Asset protection: If your property is a significant investment, high-value property insurance can help safeguard it against potential risks.

Claims Process and Customer Support

When it comes to high-value property insurance, the claims process and customer support play a crucial role in ensuring a smooth experience for policyholders. Let's delve into the typical claims process for high-value property insurance and the level of customer support provided by insurers.

Claims Process for High-Value Property Insurance

- Policyholders need to report the claim to their insurance company as soon as possible after the incident occurs.

- Insurers will assign a claims adjuster to assess the damage and determine the coverage amount based on the policy terms.

- Once the claim is approved, policyholders will receive compensation for the damage to their high-value property.

- It is essential to provide all necessary documentation and evidence to support the claim for a faster resolution.

Customer Support for High-Value Claims

- Insurers offering high-value property insurance typically provide personalized customer support to policyholders throughout the claims process.

- Policyholders can expect dedicated claims representatives who will guide them through each step and address any concerns or questions they may have.

- Customer support for high-value claims is often available 24/7 to ensure policyholders receive immediate assistance in case of emergencies.

Tips to Streamline the Claims Process

- Keep an inventory of your high-value possessions with detailed descriptions and photographs to expedite the claims process.

- Review your policy coverage and exclusions to understand what is included and excluded before filing a claim.

- Document any damage to your property and gather all relevant paperwork to support your claim accurately.

- Communicate promptly with your insurance company and provide updates as needed to avoid delays in processing your claim.

Final Thoughts

As we conclude our discussion on High-Value Property Insurance: Do You Really Need It?, it is evident that safeguarding high-value properties is a crucial aspect of responsible ownership. With the right insurance coverage, property owners can protect their investments and enjoy peace of mind knowing that their assets are secure.

Key Questions Answered

What factors determine the need for high-value property insurance?

The factors include property value, location, features, and market trends, all of which contribute to the necessity of specialized insurance coverage.

How is the cost of high-value property insurance calculated?

The cost is determined based on the value of the property, the level of coverage desired, and other risk factors associated with the property.

What are the specific benefits of high-value property insurance?

Unique benefits include higher coverage limits, protection against specific risks, and tailored policies to suit the individual property's needs.