Embarking on the journey of selecting between HMO and PPO Health Plans, this guide aims to provide a detailed insight into the nuances of each plan, helping you make an informed decision tailored to your healthcare needs.

Delve into the realm of healthcare options as we explore the intricacies of HMO and PPO plans, shedding light on their differences and benefits.

Understanding HMO and PPO Plans

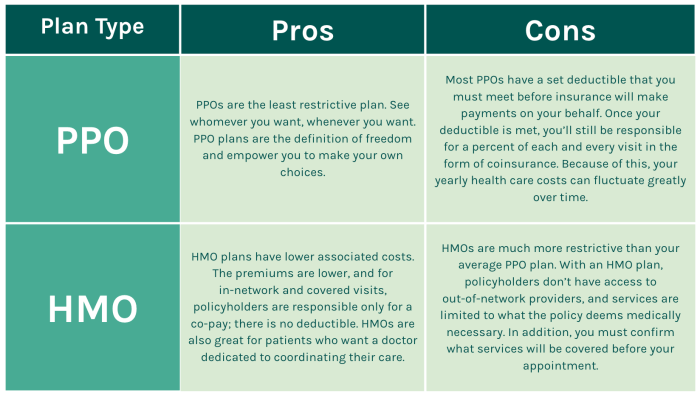

When choosing between healthcare plans, it's essential to understand the basic differences between HMO (Health Maintenance Organization) and PPO (Preferred Provider Organization) plans. Both types of plans offer different features and work in distinct ways when it comes to provider networks and referrals.

Differences between HMO and PPO Plans:

- HMO Plans:

- Key Features:

- Require members to choose a primary care physician (PCP) for all healthcare needs.

- Coverage is limited to in-network providers and requires referrals for specialist visits.

- Typically have lower premiums and out-of-pocket costs, but offer less flexibility in choosing healthcare providers.

PPO Plans:

- Key Features:

- Do not require members to choose a primary care physician and allow direct access to specialists without referrals.

- Offer coverage for both in-network and out-of-network providers, although out-of-network care is more expensive.

- Provide more flexibility in choosing healthcare providers but usually come with higher premiums and out-of-pocket costs.

Coverage and Costs

When comparing HMO and PPO health plans, it's essential to understand how coverage for medical services and costs differ between the two options.

Coverage for Medical Services

- HMO Plans: With an HMO plan, you typically need to select a primary care physician (PCP) who will coordinate your healthcare services. You must receive all non-emergency care from providers within the HMO network, and you usually need a referral from your PCP to see a specialist.

- PPO Plans: PPO plans offer more flexibility in choosing healthcare providers. You can see specialists without a referral and visit out-of-network providers, although at a higher cost compared to in-network services.

Cost Structures

- Premiums: HMO plans typically have lower premiums compared to PPO plans, making them a more cost-effective option for monthly payments.

- Copayments: HMO plans usually require lower copayments for office visits and prescriptions, while PPO plans have higher copayments but offer more freedom in choosing providers.

- Deductibles: PPO plans often have higher deductibles than HMO plans, meaning you'll need to pay more out-of-pocket before your insurance coverage kicks in.

Out-of-Pocket Expenses

- HMO Plans: While HMO plans generally have lower out-of-pocket costs for routine care, you may face higher expenses if you need to seek care outside the network without authorization.

- PPO Plans: PPO plans may have higher out-of-pocket costs overall, including deductibles, copayments, and coinsurance, especially if you choose to see out-of-network providers regularly.

Provider Flexibility

When choosing between an HMO and a PPO health plan, one crucial factor to consider is the level of flexibility in selecting healthcare providers. This aspect can greatly impact your access to medical care and the quality of services you receive.

Flexibility in Choosing Healthcare Providers

In an HMO plan, you are typically required to choose a primary care physician (PCP) from within the plan's network. Your PCP will serve as your main point of contact for all medical needs and referrals to specialists. If you need to see a specialist, you will usually need a referral from your PCP to ensure coverage.On the other hand, a PPO plan offers more flexibility in choosing healthcare providers.

While you can still opt for in-network providers to save on costs, you also have the option to see out-of-network providers without a referral. This can be advantageous if you have specific healthcare needs or prefer to see a particular specialist who may not be in the plan's network.

Impact on Access to Specialists

The network restrictions in HMO plans can sometimes limit your access to specialists, especially if the plan's network is small or lacks certain medical providers. If you require specialized care or treatment from a specific specialist, you may face challenges in receiving timely appointments or accessing the necessary services.In contrast, PPO plans typically offer a broader network of providers, including specialists in various fields.

This wider network can give you more options when seeking specialized care and may reduce the waiting time to see a specialist of your choice.

Importance of Provider Flexibility

Provider flexibility can be crucial in decision-making, especially in scenarios where you have existing relationships with certain healthcare providers or require specialized care for chronic conditions. For example, if you have a rare medical condition that requires treatment from a specific specialist, having the flexibility to choose an out-of-network provider under a PPO plan can ensure you receive the best possible care.Ultimately, understanding the level of provider flexibility offered by HMO and PPO plans is essential in selecting a health insurance plan that aligns with your healthcare needs and preferences.

Considerations for Individual Needs

When choosing between an HMO and PPO health plan, it's essential to consider various factors that align with your individual health needs. Factors such as chronic conditions, frequency of doctor visits, and geographic location can significantly influence which plan is the best fit for you.

By evaluating your personal healthcare preferences against plan benefits, you can make an informed decision that meets your specific needs.

Chronic Conditions

Individuals with chronic conditions may benefit more from a PPO plan due to its flexibility in choosing specialists without referrals. PPO plans typically offer a broader network of providers, which can be advantageous for those requiring ongoing care for chronic illnesses.

On the other hand, HMO plans may be more cost-effective for managing chronic conditions if the primary care physician can effectively coordinate all aspects of care within the network.

Frequency of Doctor Visits

If you require frequent visits to healthcare providers, a PPO plan might be more suitable as it allows you to see specialists without referrals and offers out-of-network coverage. This can be beneficial if you need to visit multiple providers regularly or have complex healthcare needs.

Conversely, if you have minimal healthcare needs and are comfortable seeing a primary care physician for most visits, an HMO plan with lower out-of-pocket costs may be more cost-effective.

Geographic Location

Your geographic location can also impact your choice between an HMO and PPO plan. If you live in a rural area with limited provider options, a PPO plan might be preferable for access to out-of-network providers. However, if you reside in an urban area with a robust network of in-network providers, an HMO plan could offer more affordable and convenient care options.

Consider where you live and the availability of healthcare providers when selecting a plan that aligns with your geographic location.

Conclusive Thoughts

In conclusion, weighing the pros and cons of HMO and PPO Health Plans is essential to securing the right coverage for your well-being. Armed with this knowledge, you can navigate the complex healthcare landscape with confidence and clarity.

Q&A

What is the main difference between HMO and PPO plans?

HMO plans require you to choose a primary care physician and get referrals for specialists, while PPO plans offer more flexibility in choosing healthcare providers without referrals.

How do out-of-pocket expenses vary between HMO and PPO plans?

In general, PPO plans tend to have higher out-of-pocket costs like copayments and deductibles compared to HMO plans.

What factors should I consider when deciding between HMO and PPO plans?

Individual health needs, frequency of doctor visits, chronic conditions, and geographic location all play a crucial role in determining which plan suits you best.